1. Introduction: The Evolution of Digital Assets

Real World Asset (RWA) tokenization is no longer just a theory; it is a tangible software reality. Our application represents the state-of-the-art of this technology, serving as a bridge between physical assets (such as real estate or commodities) and blockchain liquidity.

This article explores the application’s architecture and features in detail, demonstrating how we solved the challenges of accessibility, compliance, and on-chain management.

2. User Workflow: The Investor Experience

The main design goal of the application is to remove blockchain complexity for the end-user while retaining the benefits of transparency and security.

A. Frictionless Web3 Access

The application uses a modern wallet connection system (RainbowKit). Users do not create an account with a traditional password; their identity is their wallet.

- Wallet Guard: A proprietary security system analyzes wallet interactions in real-time to prevent the signing of suspicious transactions.

B. Dashboard and Monitoring

Once connected, the user accesses a Personal Dashboard that aggregates on-chain and off-chain data:

- Active Assets: Real-time visualization of owned tokens.

- Portfolio Valuation: Automatic calculation of total value based on the latest market prices.

- Dividends: A dedicated section shows accrued yields (e.g., rental income) in USDC, ready to be claimed.

C. The Investment Process

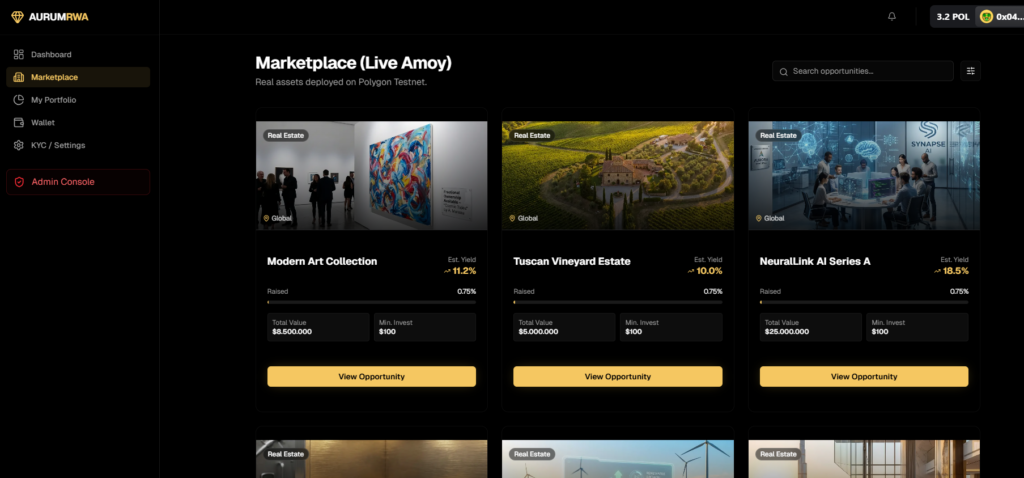

The heart of the app is the Marketplace. Each asset is presented with a “Card” summarizing key data:

- Analysis: The user opens the detail page (e.g., “Green Energy Fund I”).

- Financial Data: Access (only if verified) to balance sheets, APY projections, and notarized legal documents (hashes on blockchain).

- Purchase: Enter the amount in stablecoin (e.g., 1000 USDC). The Smart Contract calculates the token equivalent and handles the swap atomically.

3. Admin Workflow: Asset Management

Behind the scenes, the platform offers a powerful control panel for Asset Managers.

Asset Lifecycle Management

The administrator can manage the asset at every stage:

- Draft: Uploading photos, descriptions, and preliminary documents.

- Upcoming: The asset becomes visible with a countdown, useful for pre-launch marketing.

- Live: Opening of sales (Minting).

- Distribution: Automated management of dividends to all token holders.

Compliance and Integrated KYC

A crucial module is identity management. Since RWAs are security tokens, issuers must know their investors.

- Document Collection: The app allows secure uploading of documents (Passport/ID).

- Verification: The admin can approve or reject profiles with a single click.

- On-Chain Whitelist: Only wallets linked to a verified identity (KYC Approved) can interact with the purchase Smart Contracts.

4. Real-World Use Cases Implemented

The architecture’s flexibility allows for the tokenization of various asset classes. Here are some supported operational scenarios:

Residential and Commercial Real Estate

- Scenario: A real estate fund purchases a building in Milan.

- Application: The building is divided into 10,000 tokens. Investors receive their share of rent quarterly directly into their wallet.

- Advantage: Access to real estate investments with low minimum tickets ($100).

Renewable Energy

- Scenario: Financing a new solar park.

- Application: Tokens represent specific solar panels. Yield is linked to the sale of generated energy.

- Advantage: Total transparency on energy production and returns.

Private Equity & Startups

- Scenario: An incubator allows its community to invest in early-stage startups.

- Application: Tokens represent equity shares (SAFE or stock).

- Advantage: Liquid secondary market for traditionally illiquid assets.

5. Core Technology and Security

The application is built on a hybrid tech stack that combines Web2 performance with Web3 security.

- Smart Contracts (EVM): The settlement layer. Manages ownership, transfers, and whitelist logic. Audited to ensure maximum fund security.

- Relational Database (SQL): Manages rich metadata (descriptions, images, user relationships) that would be too expensive to store on-chain.

- Frontend Infrastructure: Built in Next.js to ensure fast rendering (SSR) and SEO optimization.

- Security: Integration of best-in-class practices such as rate limiting, DDOS protection, and encryption of sensitive user data (PII).

6. Available as a White Label Solution

This entire technological infrastructure is not just a demonstration but a mature software product available for third-party companies.

The platform is designed as a White Label solution. This means that Investment Funds, Real Estate Developers, and Financial Firms can adopt this technology, fully customizing it with their own brand (Logo, Colors, Domain) without having to develop the software from scratch.

What the White Label model enables:

- Immediate Time-to-Market: The platform is ready to use.

- Focus on Business: The client company focuses on sourcing assets and investors, while the technology is already solved.

- Customization: Each instance is unique and segregated, reflecting the client’s identity.

7. Conclusion

The RWA Platform represents a concrete step forward in blockchain adoption for real finance. By combining a fluid user experience with a solid technological architecture, it makes tokenization accessible and secure.

Whether democratizing access to real estate or creating new financial instruments, this technology is ready to be the foundational infrastructure for the next generation of investments.