1. Introduction: The Trust Crisis in the Luxury Market

In 2024, the global market for personal luxury goods exceeded €300 billion. Yet, a silent, erosive threat is undermining the very foundations of this empire: trust. For decades, “Luxury” was defined by the boutique experience. The smell of leather, the glass of champagne, the sales ceremony. But today, over 30% of luxury transactions take place online or on the secondary market. In these digital or “grey” spaces, the ceremony disappears, and only the product remains. And the product alone is no longer enough to guarantee its authenticity.

This guide explores how the Digital Product Passport (DPP) is not just a technological answer to counterfeiting, but the only vehicle left to transport the brand’s aura outside the controlled walls of the boutique.

2. The “Superfakes” Paradox

European customs seize millions of counterfeit items every year, but “Superfakes” (top-tier replicas sometimes produced in the same manufacturing regions as the originals) go unnoticed. An authentication expert at Vestiaire Collective or The RealReal today takes up to 40 minutes to distinguish an authentic Birkin from a Grade A “Superfake”. And often, they get it wrong.

If the expert makes a mistake, the customer loses trust. If the customer loses trust, the resale value collapses. If the resale value collapses, the price of the new item (which is supported by the perception of “investment”) becomes unjustifiable. The DPP intervenes here: it shifts verification from the atom (the material, which can be copied) to the bit (the blockchain, which cannot be copied).

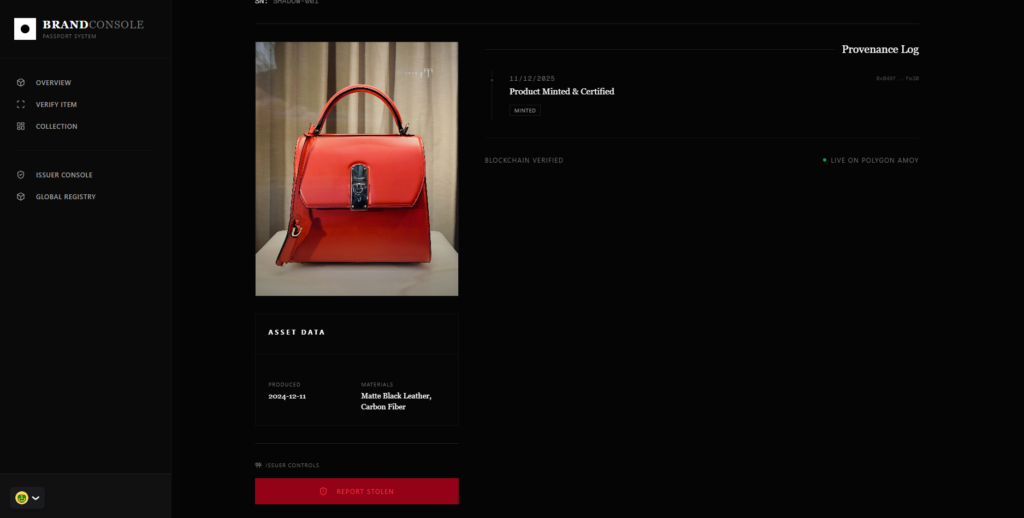

3. What is a White Label Solution

Many brands hesitate to adopt blockchain because they fear “tarnishing” their image with crypto technicalities or entrusting their customer data to external consortiums (such as Aura Blockchain Consortium or Arianee). The White Label solution solves this dilemma. Imagine an invisible technological infrastructure.

- The customer taps their phone on the bag.

- A notification appears: “Open in Safari”.

- The site that opens is

verify.gucci.comorauthenticity.hermes.com. There is no trace of the technology provider. - The design is minimalist, elegant, consistent with the brand.

This is “Invisible Security”. The customer doesn’t know they are using the Polygon or Ethereum blockchain. They only know that the bag is “speaking” to them and confirming its authenticity.

4. Case Study Analysis 1: The “Total Transparency” Approach

(Analysis based on the recent launch of Loro Piana’s “The Gift of Kings” and similar initiatives)

The Problem: An Ultra-Luxury brand does not have a mass counterfeiting problem, but it has a price justification problem. Why does this wool cost €5,000? The modern customer wants to know more. They want to know which sheep produced the wool.

The DPP Solution: The brand implements a digital passport focused on the Supply Chain.

- Origin: The DPP shows the region of New Zealand or Mongolia where the fiber was harvested.

- Processing: Shows the date of arrival in Italy and the spinning mill.

- Certification: Includes sustainability and ethical certificates (e.g., non-mulesing).

Result and ROI: Authenticity here serves not to say “It’s not fake”, but to say “It’s worth every cent”. This approach transforms the DPP into a Storytelling tool. The customer spends 4 minutes on the passport website (very high dwell time) exploring the journey of their garment. Technology becomes an amplifier of perceived value.

White Label Application: A White Label system allows uploading this multimedia data (videos of shepherds, photos of the factory) directly into the “digital twin” at the moment of production, creating an unbreakable bond between the physical object and its story.

5. Case Study Analysis 2: The “Circular Revenue” Model

(Analysis based on Breitling logic and the Rolex Certified Pre-Owned program)

The Problem: The secondary market for watches and bags is worth 50% of the primary market. Currently, brands collect Zero Euros from these transactions. A bag sold 3 times generates profit for 3 retailers, but only once for the manufacturer.

The DPP Solution with Royalties: The Digital Product Passport is programmed with a Smart Contract that includes a “Royalty Fee” (e.g., 5%).

- Scenario: Marco sells his bag to Luke.

- Transfer: To transfer ownership of the digital passport (and thus proof of authenticity), Marco and Luke use the brand’s app or integrated marketplace.

- Payment: At the moment of payment, the Smart Contract splits the sum: 95% goes to Marco, 5% is automatically sent to the Brand’s wallet.

Result and ROI: This transforms the product from a “one-time sale” to a “perpetual revenue stream”. If an iconic bag changes hands every 3 years, the brand continues to monetize that asset for decades. Furthermore, the brand acquires the data of the new owner (Luke), who was previously anonymous. Now Luke is in the CRM and can be invited to the boutique for maintenance or to buy the new collection.

6. Gen Z Psychology: Access vs. Ownership

Gen Z and Millennials (who will represent 70% of the luxury market in 2026) have a different concept of ownership. For them, Resale Value is a primary purchasing factor. They buy already thinking about how much they will be able to resell for. A product equipped with a White Label DPP is, in the eyes of a Gen Z, a Liquid Asset. It is easier to sell, safer, and therefore worth more. Offering a DPP is not a “tech plus”, it is a financial requirement to justify the investment in the good.

7. Technical Implementation Guide: NFC vs QR Code

When designing a White Label solution, the choice of the physical-digital “bridge” is crucial.

The QR Code Option (Entry Level)

- Pros: Zero cost (printing on label), easy to implement immediately.

- Cons: Easily copyable (photocopyable). Low level of perceived security. Ruins product aesthetics if visible.

- Verdict: Good for packaging or mid-range items (T-shirts, entry-level Sneakers).

The Encrypted NFC Option (High End)

- Pros: Invisible (embedded in the heel, lining, logo). Impossible to clone (each chip has a unique cryptographic key that generates a different URL with every scan, rolling code technology). “Magical” experience (Tap to Verify).

- Cons: Hardware cost (€0.50 – €2.00 per piece). Requires manufacturing integration.

- Verdict: Mandatory for leather goods, footwear, and outerwear over €500.

LUXdpp natively supports encrypted NFC (such as NTAG 424 DNA), ensuring that even if the physical chip were cloned, it would still be impossible to generate the correct digital signature required to access the passport.

8. Conclusion: The ROI of Authenticity

How much does it cost to lose a customer who buys (unknowingly) a fake believing it to be real? The reputational damage is incalculable. How much is it worth to acquire data on all owners subsequent to the first? It’s worth millions in saved customer acquisition costs.

Implementing a White Label Digital Product Passport today costs a fraction compared to developing it in-house. With dedicated SaaS platforms, the cost per unit can drop below 1% of the production cost, but the added value perceived by the customer is often double-digit. It is not a question of “if” luxury will adopt this technology. It is a question of who will do it first, defining the standard.